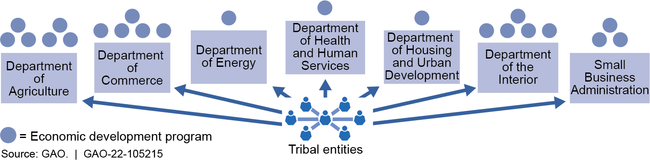

Federal efforts to support economic development among tribal entities (such as tribal governments and businesses) show evidence of fragmentation and some overlap. Programs are fragmented across seven agencies: the U.S. Departments of Agriculture (USDA), Commerce, Energy, Health and Human Services, Housing and Urban Development, and the Interior, and the Small Business Administration (SBA). Tribal organizations GAO spoke with said many tribes have limited capacity to identify and access programs and may not be aware of the federal assistance available. The Secretary of Commerce is required by law to assist tribes and other eligible entities with identifying and taking advantage of business development opportunities; however, the department does not maintain information on federal economic development programs across agencies available to tribal entities. Without information on available programs, tribal entities may not access programs that could provide valuable benefits to tribal communities. GAO did not find evidence of duplication.

Fragmentation among Economic Development Programs Available to Tribal Entities, Fiscal Year 2021

GAO identified eight programs that are specifically for tribal entities and provided over $930 million in grants and loan guarantees in fiscal years 2017–2021. An additional 14 programs have a wider range of eligible recipients, such as small businesses or local governments, as well as tribal entities. The total amount of assistance provided by these 14 programs to tribal entities is unknown because two agencies—SBA’s Office of Capital Access and USDA’s Farm Service Agency—do not analyze data to estimate obligations provided to tribal entities. Estimating and reporting the amount of program obligations provided to tribal communities would allow federal agencies and decision makers, such as Congress, to better understand the reach of these programs and identify areas where tribal entities may need additional support.

GAO identified several tax incentives that can contribute to economic development in tribal communities. However, data to evaluate whether tribal entities use these incentives are limited. In the absence of more specific data, location data can be used to estimate the extent to which some tax incentives have reached tribal communities. For example, using location data for the New Markets Tax Credit, GAO estimated that from 2004 through 2019, tribal communities (defined as individuals and businesses on or near reservations, trust land, or Oklahoma Tribal and Alaska Native Village Statistical Areas) received between $734 million and $891 million of investment (1.3 to 1.6 percent of the total dollars invested via the credit).

Why GAO Did This Study

Historically, tribal communities have experienced higher rates of unemployment and poverty than nontribal communities. Tribal economic development may help address these challenges and also provides benefits to tribes and surrounding areas. The federal government administers programs to facilitate this development.

The Indian Community Economic Enhancement Act of 2020 includes a provision that GAO conduct a study on Indian economic development. This report examines economic development programs available to tribal entities and the extent of fragmentation, overlap, and duplication among these programs; analyzes available data on obligations to tribal entities for these programs; and describes selected tax incentives available to tribes and related data, among other objectives. GAO reviewed program information, analyzed obligations data, and interviewed tribal entities, agency officials, and Native Community Development Financial Institutions.