AI/ANs may be subject to premiums and cost-sharing when enrolled in health insurance coverage through a Marketplace. But Indian-specific cost-sharing protections may fully eliminate any cost-sharing requirements and may have the effect of reducing the health insurance premium for an AI/AN.

There are Indian-specific cost-sharing protections available through a Marketplace for persons who meet the eligibility criteria as an Indian (i.e., Member of an Indian tribe or shareholder in an Alaska Native regional or village corporation). There are not Indian-specific premium tax credits. AI/ANs are eligible for the premium tax credits available to the general population.

AI/ANs (meeting the definition of Indian under the ACA) with income above 100% and below 300% of the federal poverty level (FPL), and eligible for premium tax credits:

Can enroll in a zero cost-sharing plan, which means no copayments, deductibles, or coinsurance when receiving essential health benefits (EHBs) from Indian health care providers or when receiving EHBs through non-Indian health care providers.

Do NOT need a referral from an Indian health care provider to receive cost-sharing protections when served by non-Indian health care providers.

AI/ANs (meeting the definition of Indian under the ACA) who are not eligible for the zero cost-sharing variation (because of income under 100% FPL, income over 300% FPL, not declaring income level, and/or not being eligible for PTCs:

– Can enroll in a limited cost-sharing plan, which means no copayments, deductibles, or coinsurance when receiving EHBs from Indian health care providers or when receiving EHBs from non-Indian health care providers.

–Do need a referral from an Indian health care provider to avoid cost-sharing when receiving EHBs through a non-Indian health care provider.

AI/ANs eligible for the Indian-specific cost-sharing protections can enroll in a bronze plan and still receive the Indian-specific cost-sharing protections. For the general population, individuals need to enroll in a silver-level plan to receive cost-sharing assistance. Because eligible AI/ANs can enroll in a lower-cost bronze plan and still receive full cost-sharing assistance, they are able to enroll in comprehensive coverage with a lower net premium than non-AI/ANs. But, there is not Indian-specific premium assistance. AI/ANs have access to the premium tax credits that are available to the general population.

The short answer is “Yes”.

The zero and limited cost-sharing protections provide 100% coverage of OOP costs (deductibles, co-insurance, co-payments). And this is true whether the provider is in-network or out-of-network. Cost-sharing protections apply to “covered”, “essential health benefits”(EHBs) .

As you know, for the limited cost-sharing version, a referral for cost-sharing is needed when receiving services from a non-Indian Health Care Provider.

There are a couple of clarifications.

1 – A health service has to be an “essential health benefit” for the federal cost-sharing protections to apply (zero or limited). (But, a health plan could impose no cost-sharing for non-EHBs if it wants.)

2- The service has to be a “covered service” by the health plan for the cost-sharing to be covered by the federal government.

a. In general, if the plan doesn’t pay any amount for a particular service, the service is likely not “covered”. For example, some plans do not cover any EHBs (or any EHBs that are of a certain type, like certain classes of medicines) when provided by out-of-network providers, so the patient would be liable for 100% of the costs as these costs are not considered cost-sharing. Or, the prior authorization requirement wasn’t met, so the service isn’t considered “covered”.

b. Conversely, if the plan pays any amount, it is a covered service (assuming it is an EHB). So, if a plan lists a standard co-insurance amount (such as 20%) for a particular type of service when seen by an out-of-network (or non-network) provider, it is a covered service and the standard co-insurance amount is covered by the health plan for limited and zero cost-sharing plan enrollees.

3- Balance billing charges are not covered as they are not considered “cost-sharing.

To recap, the Indian-specific zero and limited cost-sharing protections (sometimes identified by “02” and “03”, respectively) provide full protections against cost-sharing (i.e., deductibles, co-insurance, and cost-payments) for covered EHBs when seen by in-network and out-of-network providers. Balance billing charges are not considered “cost-sharing”. And, the Indian-specific cost-sharing protections only apply to covered EHBs.

All family could enroll in the same plan, but the cost-sharing reductions provided to all families members would be the least generous cost-sharing protections any one family member was eligible to receive.

For example, for a family consisting of two AI/ANs and two non-AI/ANs who have household income of 200% FPL, if all four enroll in the same “family plan” the cost-sharing protections for each family member would be the cost-sharing protections available to the non-AI/AN enrollees. (And, the family would need to enroll in a silver level plan to secure the cost-sharing protection.)

If the family members wished to secure more comprehensive cost-sharing protections for the AI/AN family members, the two AI/ANs should enroll in one family plan (at the bronze level) and the two non-AI/AN family members should enroll in a silver level family plan.

Through the Federally-Facilitated Marketplace (FFM), family members can decide to enroll in multiple health plans. When applying, the FFM suggests how to group family members in separate plans, if this is advantageous to the family members. Enrollees can accept the suggested grouping of family member or change which family members are grouped with other family members. For example, each family member could enroll in separate health plans as individuals.

When family members enroll in separate health plans, the tax credits are divided across the plans in proportion to the relative cost of each of the health plans.

In non-FFM states, families can also enroll in separate plans, but the process for doing so may be different than in the FFM.

With limited exceptions, the Affordable Care Act (ACA) was written to provide premium tax credits only to individuals with household income at or above 100% FPL. The ACA was designed to have the lowest-income individuals covered through Medicaid. After a Supreme Court ruling on this issue, though, Medicaid coverage for low-income adults without dependent children is available in a state only if the state decided to expand their Medicaid programs to cover these individuals. Individuals with household income below 100 percent of FPL are not eligible to receive premium tax credits. Further, the general population with household income under 100% FPL is also not able to access cost-sharing assistance through a Marketplace. (AI/ANs meeting the definition of Indian under the ACA are able eligible to receive cost-sharing assistance if enrolled in Marketplace coverage even if under 100% FPL, although not premium tax credits.)

No. The APTC does not need to be repaid because the enrollee is under 100% now but the Marketplace determined the individual was eligible for the subsidy when he or she applied. (This answer is found on page 5 of the IRS Instructions for Form 8962.)

Specifically:

Estimated household income at least 100% of the Federal poverty line. You may qualify for the PTC if your household income is less than 100% of the Federal poverty line and you meet all of the following requirements.

You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

The Marketplace estimated at the time of your enrollment that your household income would be between 100% and 400% of the Federal poverty line for your family size for 2014.

APTC is paid for the coverage for one or more months during 2014.

You otherwise qualify as an applicable taxpayer (without taking into account the Federal poverty line percentage).

Contact a Marketplace Call Center representative to update the application. At minimum, cost-sharing protections going forward will reflect the Indian status of the applicant/enrollee, but the Indian-specific cost-sharing protections might be applied retroactively. The applicant/enrollee should consider whether a change in metal levels would be beneficial (e.g., changing to a bronze plan) or whether there is a need to transfer into an individual policy (from a family plan) if other family members do not meet the ACA’s definition of Indian.

Yes. Please find attached the document, titled “Tables on Referrals and Payment Rates for Services for American Indians and Alaska Natives Enrolled in Marketplace Plans,” prepared by the MMPC, National Indian Health Board on May 23, 2014.

It is advised that Indian Health Care Providers (IHCPs) work with Qualified Health Plan (QHP) issuers to establish procedures for providing a referral to the QHP and/or provider

In general, though, a patient should always get a referral in order to avoid cost-sharing (whether in the form of a referral letter or card) when visiting the provider for a referred service. A copy of the referral should be issued by the I/T/U and provided to the patient to give to the provider.

Alternatively, some IHCPs might establish a process with a QHP issuer under which: (1) the IHCP would issue a comprehensive referral at the time of initial enrollment in the QHP; and, (2) the QHP issuer would record in the patient’s eligibility file that the patient is eligible for elimination of all cost-sharing requirements for essential health benefits, as a referral is on file with the QHP issuer. Under this alternative, streamlined process, at the time a patient is accessing a health service, the provider would be able to determine that no cost-sharing is due either by viewing the information on the QHP-issued enrollment card, accessing an online data base, or calling/e-mailing the QHP issuer.

A closed panel QHP could be the best option for a Marketplace enrollee (even for an enrollee who meets the definition of Indian). However, before selecting a closed panel plan, the enrollee should first consider the limitations of electing this option.

With limited exceptions, a closed panel plan only makes payment for services rendered by providers within the plan’s provider network. And because the services provided by non-network providers are considered “non-covered services” by the QHP, cost-sharing protections do not apply to these services. (An exception applies to emergency services, for which payment would be provided and cost-sharing protections would apply.)

Although a Tribe might not own a clinic, if the patient wishes to see other IHCPs (or non-IHCPs) that are not in the QHP’s network, services rendered by these IHCPs are likely to be considered non-covered services. As non-covered services, the QHP generally will not make payment for these services. And again, cost-sharing protections do not apply to non-covered services.

Under section 206 of the Indian Health Care Improvement Act (IHCIA), IHCPs can seek reimbursement for services provided to closed panel plan enrollees. However, because the services are considered non-covered services by the QHP issuer and cost-sharing protections do not apply to non-covered services, any cost sharing that does apply will be deducted from any payments the QHP issuer makes to an IHCP. Given that most Marketplace enrollees meeting the definition of Indian will enroll in bronze-level coverage, a sizeable deductible might be applied to the payment to the IHCP under IHCIA section 206, significantly reducing or completely eliminating any payment to the IHCP.

For services provided by non-network, non-IHCPs, no payment at all would be made to the provider for services provided to a Marketplace enrollee. The enrollee, or a Tribal health organization’s PRC program on behalf of the enrollee, would be liable for payment to the non-network, non-IHCP.

An individual must be enrolled in coverage through a Marketplace in order to secure the comprehensive Indian-specific cost-sharing protections. If you have not already done so, it is recommended that you contact the Marketplace Call Center to complete the application. If this is not successful, consider submitting a complaint through a Marketplace Call Center if this issue appears to be an error on the part of the Marketplace. In addition, feel free to submit a request through the Self-Governance Communication and Education website at: www.TribalSelfGov.org “Q&A” mechanism for TSGAC assistance in seeking resolution directly with CMS/CCIIO.

Yes. All Marketplace eligibility determinations that are based on income use “household” income. This is true whether applying for enrollment in an individual or family plan, and whether or not other family members seek Marketplace coverage at all.

I understand that you are an enrolled Tribal member and your spouse is not. Under the Affordable Care Act, enrolled Tribal members (“Indians”) are eligible for Indian-specific comprehensive cost-sharing protections when securing health insurance coverage through a Marketplace. Non-Indians are NOT eligible for these comprehensive cost-sharing protections. (There are lesser cost-sharing protections for Marketplace enrollees who are not Indians with household income less than 250% of the FPL.)

Whether to “apply separately” or together, is an important issue. You and your spouse can enroll at the same time / on the same application through healthcare.gov. But, when selecting the health plans you are enrolling in, you and your spouse should enroll in different plans. If you enroll together in the same plan, you would lose your comprehensive (Indian-specific) cost-sharing protections.

– If your spouse wants low(er) out-of-pocket costs, a gold level plan might be more attractive (although the premium is higher) than a bronze plan.

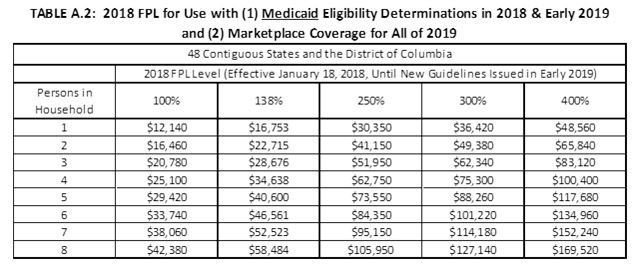

-If your and your spouses’ household income is at or below 250% of the federal poverty level (See table below for various household sizes), your spouse might be eligible for the cost-sharing protections for the general population BUT ONLY IF ENROLLED IN A SILVER PLAN.

For you (as an enrolled Tribal member), it is typically most beneficial to enroll in a bronze plan, where the premium is lowest and the federal government picks-up the greatest amount of cost-sharing. –

–

On other note: As an Indian, you are eligible to enroll in a Monthly Special Enrollment Period (M-SEP), which means you can enroll all year in the Marketplace, and not just during the annual open enrollment period. Your spouse can also enroll during a M-SEP, BUT ONLY IF ENROLLING WITH YOU as you are an enrolled Tribal member.

In short, the income calculations made for purposes of the premium tax credits are the same calculations that are used for purposes of determining eligibility for the Indian-specific cost-sharing protections. So, the treatment of SDDI income is the same for the PTC and cost-sharing reduction purposes.

One point on the Indian-specific cost-sharing reductions: no matter your income, an enrolled Tribal member is eligible for the Indian-specific cost-sharing reductions (CSRs).

– For an enrolled Tribal member with household income between 100% of the federal poverty level (FPL) and 300% FPL, and is eligible for premium tax credits, the individual is eligible for the “zero CSRs”.

– For an enrolled Tribal member who is not eligible for the “zero CSRs”, the individual is eligible for the “limited CSRs”. (This includes individuals with no income or $1 million.)

And, the CSRs are only available when enrolling in health insurance coverage through a Health Insurance Marketplace.

(NOTE: This Q&A is for informational purposes only and is not intended as legal advice.)

Yes, if funds withdrawn from a retirement account are considered taxable.

The Marketplace determines eligibility for premium tax credits (PTCs) based on the information that individuals applying for enrollment provide about their expected annual household income and family size. If individuals who qualified for PTCs at the time of Marketplace enrollment experience a change in income during the year, their PTC eligibility might change. Events that could result in a significant increase to income include:

– Lump sum payments of Social Security benefits, including Social Security Disability Insurance;

– Lump sum taxable distributions from an individual retirement account or other retirement arrangement; and

– Debt forgiveness or cancellation, such as the cancellation of credit card debt.

PTC-eligible individuals whose annual income increases to an amount exceeding 400% of the federal poverty level (FPL) might lose their PTC eligibility (and have to repay any advance payments of PTCs at the time they file their tax return). As such, PTC-eligible individuals should consider carefully the financial implications of potentially losing their PTC eligibility before withdrawing funds from a retirement account. It also is recommended that PTC-eligible individuals who opt to withdraw funds from a retirement account (or who experience another significant increase in income) immediately report the change in income to the Marketplace; by doing so, the Marketplace can make an adjustment to the amount of their advanced payments of PTCs for the remainder of the year, thereby reducing the amount of PTCs these individuals might have to repay at the time they file their tax return.

There are two issues that are combined in the question.

1. IRS Form 8965 is a form that was used through calendar/tax year 2018 to claim an exemption from the requirement under the Affordable Care Act (sometimes referred to as the “individual mandate”) to secure health insurance coverage. Enrolled Tribal members and other IHS eligible individuals are eligible for the exemption from the individual mandate. So, for claiming the exemption from the individual mandate, Form 8965 is used when filing federal income taxes. The individual mandate was eliminated for all Americans for calendar/tax year 2019 and going forward. Therefore, beginning with calendar / tax year 2019, there is no longer a need to claim an exemption when filing taxes.

2. A separate issue is with respect “to reconcile on taxes”. I am assuming that the individual who secured health insurance coverage through the Marketplace (and received the “zero” cost-sharing protections) received premium tax credits to reduce the net health insurance premium costs the individual had to pay. It is necessary for the individual to file federal income taxes for the year the premium tax credits were received in order to “earn” the premium tax credits (otherwise, all the premium tax credits received over the year have to be paid back). Through the federal income tax filing process, the amount of premium tax credits paid out over the year for the Marketplace enrollee (based on the enrollee’s

estimated income for the year) is “reconciled” with the amount the individual was eligible to receive, based on the individual’s actual year-end income for the year.

So, if enrolled in health insurance coverage during calendar/tax year 2018, the individual would need to file taxes for calendar/tax year 2018. Based on the individual’s reported income (and household size), the amount of premium tax credits paid out over the year would be compared (“reconciled”) with the amount of premium tax credits calculated as “earned” when preparing the individual’s taxes. (The federal government sends the enrollee a Form 1095-A by the end of January 2019 that indicates how much in premium tax credits were advanced to the health plan over 2018 on the individual’s behalf.) When filing federal income taxes (for 2018 in 2019), the enrollee fills out Form 8962 to reconcile the premium tax credit amount “advanced” over 2018 (which is reported to the individual by the IRS on Form 1095-A) versus the amount “earned” for 2018 (based on actual income for 2018).

Here is a section of the IRS website on this topic:

“Claiming and Reconciling the Credit”

If you get the benefit of advance credit payments in any amount – or if you plan to claim the premium tax credit – you must file a federal income tax return and attach Form 8962, Premium Tax Credit, to your return. You claim the premium tax credit and reconcile the credit with the amount of your advance credit payments for the year on Form 8962. You must file a return even if you’re usually not required to do so. Failing to file your tax return will prevent you from receiving the benefit of advance credit payments in future years. For more information on filing a return to claim and reconcile the credit see Premium Tax Credit: Claiming the Credit and Reconciling Advance Credit Payments. Filing electronically is the easiest way to file a complete and accurate tax return. Electronic filing options include free volunteer assistance, IRS Free File, commercial software and professional assistance.

https://www.irs.gov/affordable-care-act/individuals-and-families/the-premium-tax-credit-the-basics

And here is a separate section on the IRS website:

The Marketplace will send you a Health Insurance Marketplace statement, Form 1095-A, by January 31 of the year following the year of coverage. This form shows the amount of the premiums for your and your family’s health care plans. This form also includes other information – such as advance credit payments made on your behalf – that you will need to compute your premium tax credit.

https://www.irs.gov/affordable-care-act/individuals-and-families/premium-tax-credit-claiming-the-credit-and-reconciling-advance-credit-payments

If an individual who received premium tax credits ends up having higher income than the amount of income reported to healthcare.gov (when applying or sometime later during the year), the individual might need to pay back a portion of the premium tax credits received. Conversely, if the individual’s income was lower, they might receive a PTC payment from the IRS after filing federal income taxes.

As stipulated by 45 CFR 158.240, for each medical loss ratio (MLR) reporting year, a health insurance issuer must provide a rebate to each enrollee if its calculated MLR does not meet or exceed the minimum required percentage (80% in the individual market, unless the state in which the issuer operates sets a higher requirement). The amount of the (aggregate) rebate is calculated as the difference in the calculated MLR of the issuer and the minimum required percentage (3.6%, in the case of Premera in 2018) multiplied by the following: total premium revenue (full premiums paid), after subtracting federal and state taxes and licensing and regulatory fees and after accounting for payments or receipts for risk adjustment, risk corridors, and reinsurance. The issuer then must pay a share of the aggregate rebate to each enrollee based on the percentage of total premium revenue for which the enrollee accounted.

In short,

– The “full premium” amount is determined from a number of calculations and adjustments. A Tribe or Tribal health organizations will not have access to all the information necessary to calculate an exact rebate amount for any individual. For example (not explicitly mentioned above), one adjustment is that health plans are paid a 15% risk adjustment amount for individuals enrolled in limited or zero cost-sharing variations.

– There is not an adjustment (withhold) of a portion of the rebate to an individual based on who paid the premium. Meaning, if there are PTCs involved, there does NOT appear to be a deduction in the amount of the rebate. The issuer is to provide a rebate based on the “full premium”, as calculated.

There is a need to check with a tax expert to determine the particulars of any individual tax payer.

Given that the health insurance premiums for a Tribal member might be paid by a Tribe or Tribal health organization (referred to as Sponsorship) and not the individual, the standard Q&As prepared by IRS do not fully match the particulars of Sponsored enrollees, but here is a link on the topic.

https://www.irs.gov/newsroom/medical-loss-ratio-mlr-faqs

Given that Sponsored individuals do not pay the premiums, if the Sponsored individual receives a rebate, the amount of the rebates likely is taxable to the enrollee / rebate recipient.

Here is the standard IRS materials on the topic (again, which doesn’t directly apply to Sponsored enrollees):

– With regard to whether the MLR rebates are considered taxable income, per the IRS, if an enrollee receiving a rebate deducted the associated premium payments from his or her taxes (on Schedule A of Form 1040 or, if self-employed, on line 29 of Form 1040), the rebate is taxable to the extent that the individual received a tax benefit from the deduction. However, if the enrollee receiving a rebate did not deduct the associated premium payments from his or her taxes, the rebate is not taxable.

And one portion of the linked Q&A provides this information:

“For a cash rebate paid to an individual policyholder, Insurance Company is not required to file a Form 1099-MISC with respect to that payment or furnish a Form 1099-MISC to the individual policyholder unless (1) the total rebate payments made to that policyholder during the year total $600 or more, and (2) Insurance Company knows that the rebate payments constitute taxable income to the individual policyholder or can determine how much of the payments constitute taxable income.”

The understanding we have is –

1- Based on discussions with CMS staff, the federal government will not attempt to collect cost-sharing protections that have been paid out, even if there is a change of status (such as due to a change in income) over the course of the year. (This assumes there is no fraud).

2- Although the “zero cost-sharing variation” is available only to enrolled Tribal members with household income between 100% and 300% of the federal poverty level (as well as needing to have premium tax credit eligibility), the “limited cost-sharing variation” is available to enrolled Tribal members of any income level.

3- The difference between the “limited” and “zero” cost-sharing protections is that, under the “limited” cost-sharing protections a “referral for cost-sharing” is needed from the IHS or a Tribal health organization when securing services from providers outside the Indian health system in order to secure the cost-sharing protections.

4- You are required to report changes to your income and household to healthcare.gov “as soon as possible” https://www.healthcare.gov/reporting-changes/why-report-changes/. This will update your eligibility, possible changing from “zero” to “limited” cost-sharing protections.

5- As such –

– If your projected income has changed, I recommend that you revise your projected household income reported on your Marketplace coverage application.

– You are not likely to be asked to pay back the cost-sharing protections you received.

Some or all of the “advanced” premium tax credit payments sent to your health plan on your behalf this year may have to be repaid, and the monthly premium you owe for future months might increase, after reporting a change in income. Although it is beneficial to retain your coverage, you are not required to continue enrolling / paying for the health insurance coverage through the end of the coverage/calendar year. You can dis-enroll through established procedures.

– To be extra certain on not having to repay cost-sharing protections provided to date, you can request that Cherokee or other Tribe/Tribal health organization issue to you retroactively a “referral for cost-sharing” form and you provide it to your health care providers and/or insurance carrier for the services received earlier this year. There is no prohibition from the Marketplace on the referrals for cost-sharing being provided after a health care service is received.

– You might want to request a referral for cost-sharing from your Tribal health organization for any out-of-pocket costs associated with future health services covered by your Marketplace health plan.